Some eCommerce businesses are inherently at greater risk than others when it comes to online fraud. For business owners selling luxury goods and other high-ticket items, one of the absolute worst feelings is finding out that a purchase was fraudulent and being out a handsome amount of cash.

Just like Big Box stores became a large target for shoplifting, eCommerce stores are becoming the playground of scammers trying to exploit the goodwill (and technology!) of online store owners.

What can WooCommerce store owners do to mitigate fraud risks while still maintaining an ‘easy to purchase from’ experience? What technology options are available and affordable? And is fraud a growing reality that every eCommerce brand needs to take seriously?

We’ll answer all these questions and more as we look at Trust Swiftly and this unique security layer that is easy to add to any WooCommerce store.

Are Fraudulent Payments on The Rise for Ecommerce Stores?

One of the responsibilities of any growing business is to create and implement systems, processes, and general due diligence. Doing so ensures that the business creates more and more success. Successful businesses bring that success to their customers through increased trust, lower prices, and better buying experiences.

Allowing fraudulent actors to steal money from your business puts the business’s bottom line at risk and reduces what can be passed on to customers. Everyone loses in this situation, especially if a business is especially susceptible to fraudulent transactions.

According to Statista, there is a noticeable and alarming increase in eCommerce payment fraud. In 2020, 17.5 billion U.S. dollars were lost due to payment fraud. In 2021, that increased to 20 billion U.S. dollars. The losses are deep but also wide. 40% of online retailers had reported that they had lost out on fraudulent transactions. Non-reported fraud likely pegs the percentage of affected businesses much higher.

This means that 40% of businesses reported $20 billion in losses in one year. In fact, half of the eCommerce businesses say that online payment fraud is the type of fraud that they are most worried about and spending the most time trying to prevent.

How Do People Commit Payment Fraud?

Ecommerce fraud can come in many forms, but most often it happens when someone uses a stolen credit card or identity to make a purchase. The fraudster is hoping to get something for nothing and leave the business owner with an expensive chargeback.

Synthetic identities are identity profiles that fraudsters give to businesses that can be a mix of real identity and fake information. Even when some information is real, it isn’t the person who is committing the fraud and is likely a partly stolen identity.

Friendly fraud happens mostly by mistake. These are accidental incidents where a charge is not recognized and then is marked negatively by a bank. This often happens with shared cards where the cardholder doesn’t necessarily know all the charges that take place by a family member, business partner, or through 3rd party services like an app store or voice system (Alexa, etc.).

How to Stop Payment Fraud?

There are a few things businesses can do to protect themselves from eCommerce fraud.

First, they can verify all orders before shipping them out. This can be done by calling the customer or checking their billing address against the shipping address. This, however, is cumbersome due to the manual nature of the task. A high-volume store could easily be bogged down in verification tasks that could and should otherwise be automated.

Second, businesses should use strong authentication methods like two-factor authentication for logging into accounts and making payments. Unfortunately, this doesn’t always work since even 2FA can be compromised if it is the lone defense mechanism at play in an eCommerce store.

Finally, businesses can keep an eye out for red flags like large orders from new customers or orders that are being shipped to locations that don’t match the billing address. While this is more manual work, it probably is a best practice for an online store’s fulfillment team. This still can’t catch fraud before the order is made and increases the amount of work that is necessary by paid employees.

How Can Identity Verification and Machine Learning Prevent Fraud?

Trust Swiftly is an eCommerce identity verification platform that protects online retailers from more fraud around the clock. It works with major commerce platforms such as Plaid, Stripe, PayPal, Sift, and now WooCommerce. Trust Swiftly strikes the balance between increased security through identity verification and user experience—ensuring that customers are still delighted to purchase while reducing risk to the store owner.

What is Identity Verification for WooCommerce Stores?

Identity Verification is the process of asking for details of customers (as little as verifying access to an email account and as much as providing a picture of oneself) to find patterns that may show fraudulent behavior in the purchasing process. WooCommerce stores have access to toolsets that can ask customers to provide these details to reduce the risk of a transaction. Trust Swiftly’s WordPress plugin for WooCommerce adds these verification layers to the checkout process in a customizable fashion to get each store the level of verification that makes sense.

What does Machine Learning do in the Identity Verification Process?

When using Trust Swiftly, Machine Learning does a lot of work for the site owner. Verification Templates can be created for each store one manages—this determines which of the 15 verification methods are used. Each of those ID verification methods, when completed by the customer, is run through Machine Learning filters where rules meant to suss out bad actors are applied to them. This is like a manual review being done automatically with a large data set applied to every level of verification.

Dynamic Verification, available on certain Trust Swiftly plans, dynamic applies more or fewer verification methods based on calculated data from a customer. If the customer’s identity appears to be of high fidelity, Trust Swiftly might push them through to the end of the checkout process to create a better user experience. However, if a customer is suspicious, they may be subject to more verification methods. This does two things simultaneously:

- Slows the possible offender down which may make them lose interest and try to find a different store to defraud

- Requires more ‘proof’ or verification from them which heightens the chances of a fraudster failing verification

This is all done via the Trust Swiftly service. Other than setting up the service and installing it on a WooCommerce store, eCommerce managers do not have to manually verify customers themselves. They simply reap the rewards of a calibrated system that protects them from the increasing landscape of payment fraud.

How to Get Started with Trust Swiftly on WooCommerce?

Trust Swiftly is a SaaS security platform that integrates with several eCommerce environments to add identity verification layers to the checkout process. With Trust Swiftly’s new WordPress and WooCommerce plugin, WooCommerce store owners now have an affordable and scalable way of protecting themselves from fraud losses with simple and single integration.

1. Create a Trust Swiftly Account

To create an account with Trust Swiftly, visit their website and register a new account.

Upon creating a new account, you’ll be asked to verify your email address and fill in billing location information, and payment information. Trust Swiftly does offer a free trial so that you won’t be billed while setting up and testing out the service.

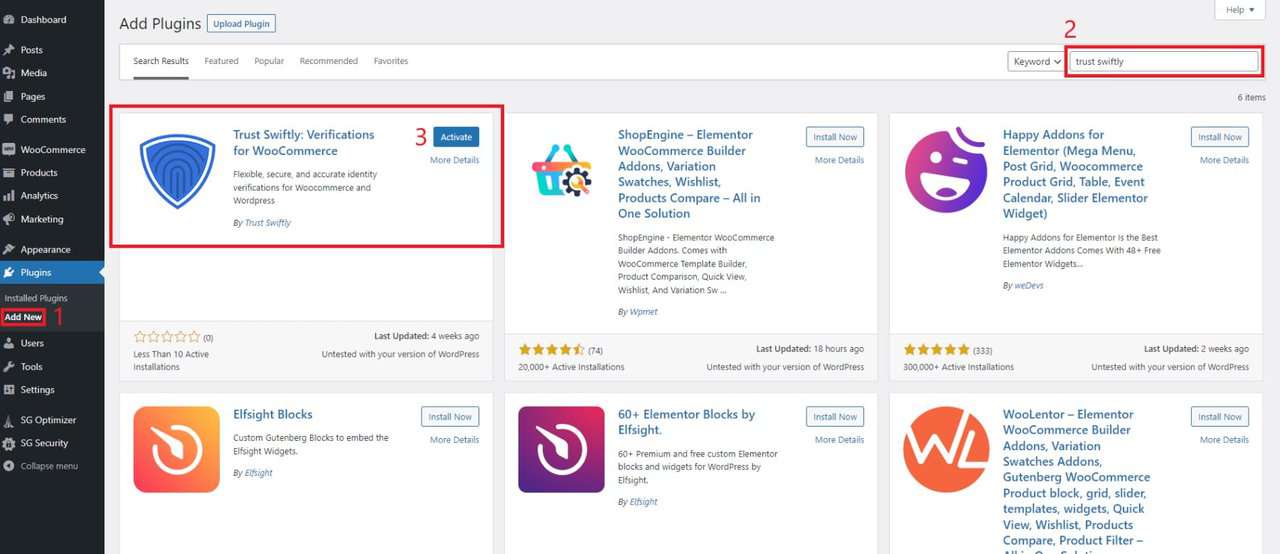

2. Download and Install the Trust Swiftly WordPress Plugin

From your website’s “Add New” plugin area, find the Trust Swiftly plugin in the Repository. Install and activate it on your WordPress activation. If your website does not run a WooCommerce installation, this plugin at its current state is probably not for you.

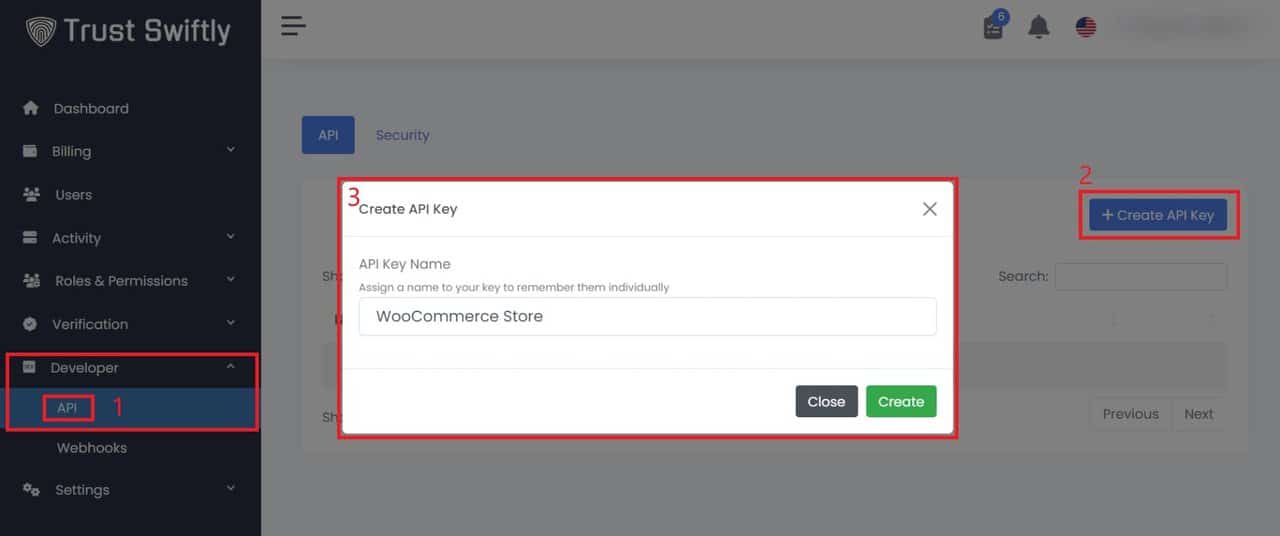

3. Set Up the Trust Swiftly API and Webhook in the Plugin

Create a new API Key in your Trust Swiftly account.

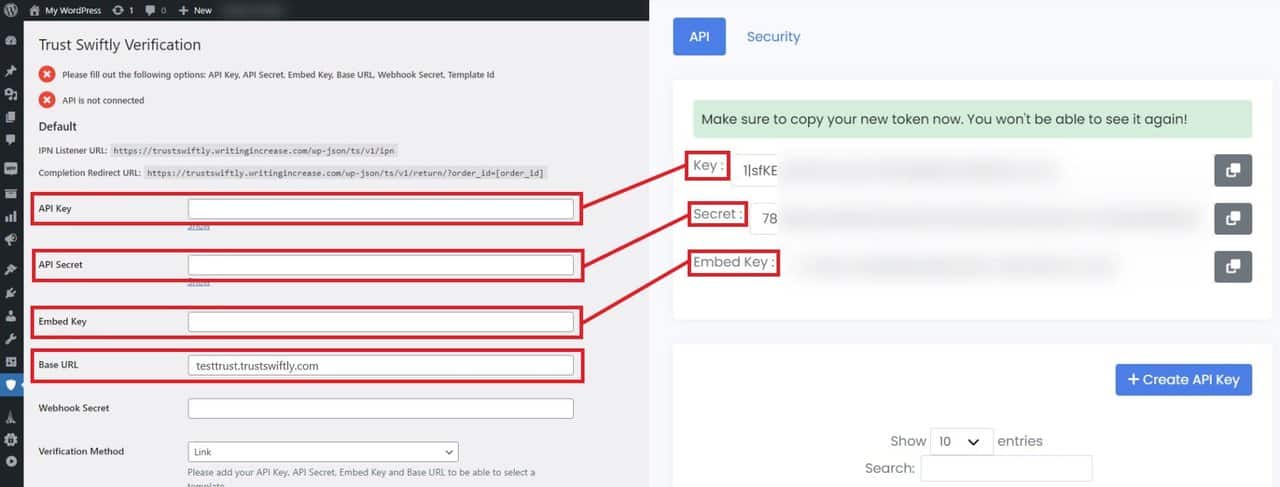

Copy the API Key, Secret, and Embed Key over to the Trust Swiftly plugin settings. Also include the Base URL that you set up at the onset of creating your Trust Swiftly account. Note: The Base URL requires “https://” to be included in the URL for it to securely connect and work.

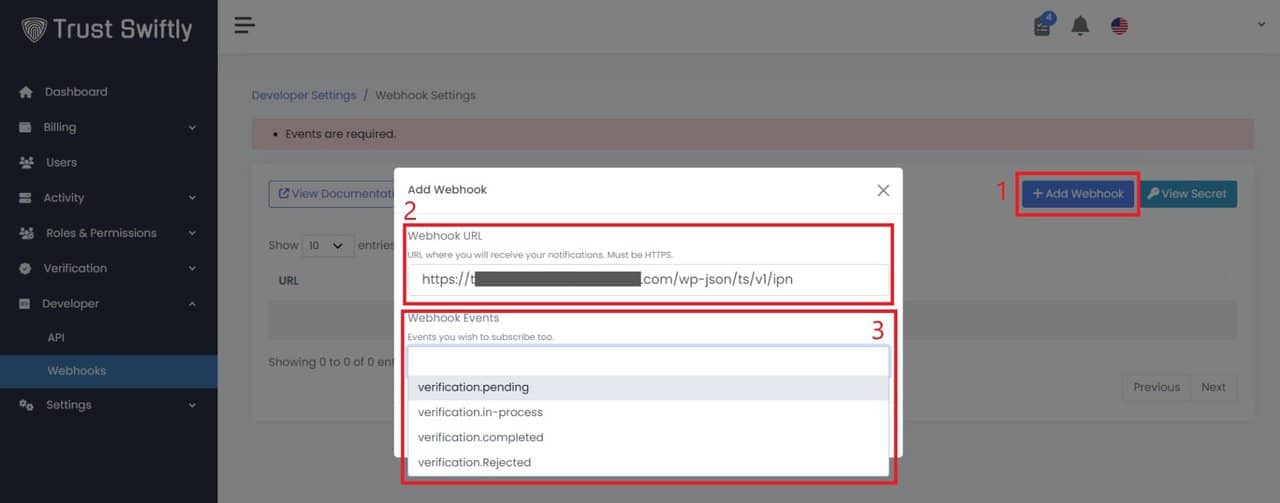

A Webhook should be created in addition to the API key. On the plugin settings page, find the “IPN Listener URL” and include that in the Webhook URL field. For events, open the drop-down and select all of them. Save and close.

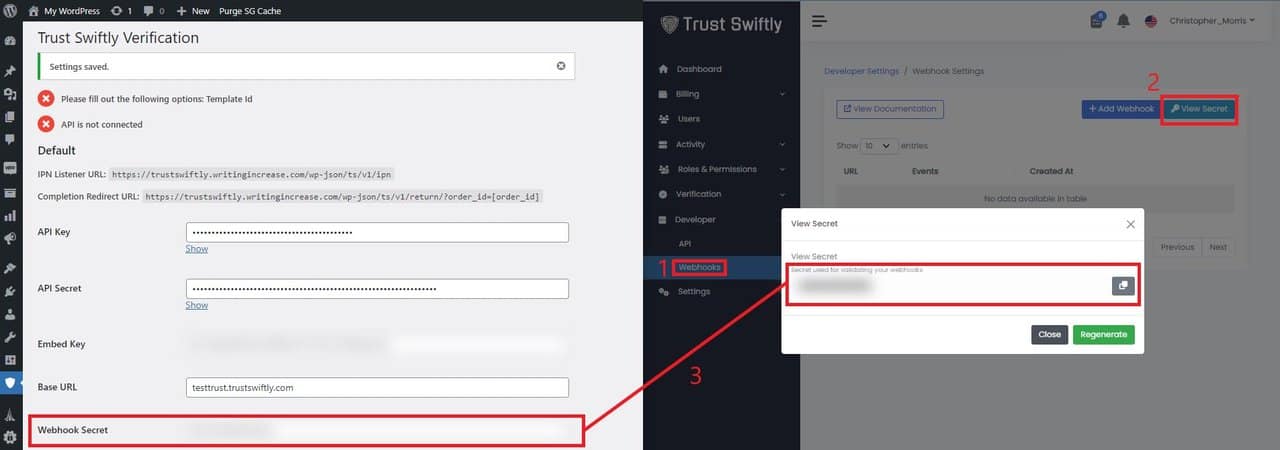

Next, add your unique Webhook Secret to the plugin settings as well.

4. Finish Account Onboarding Steps

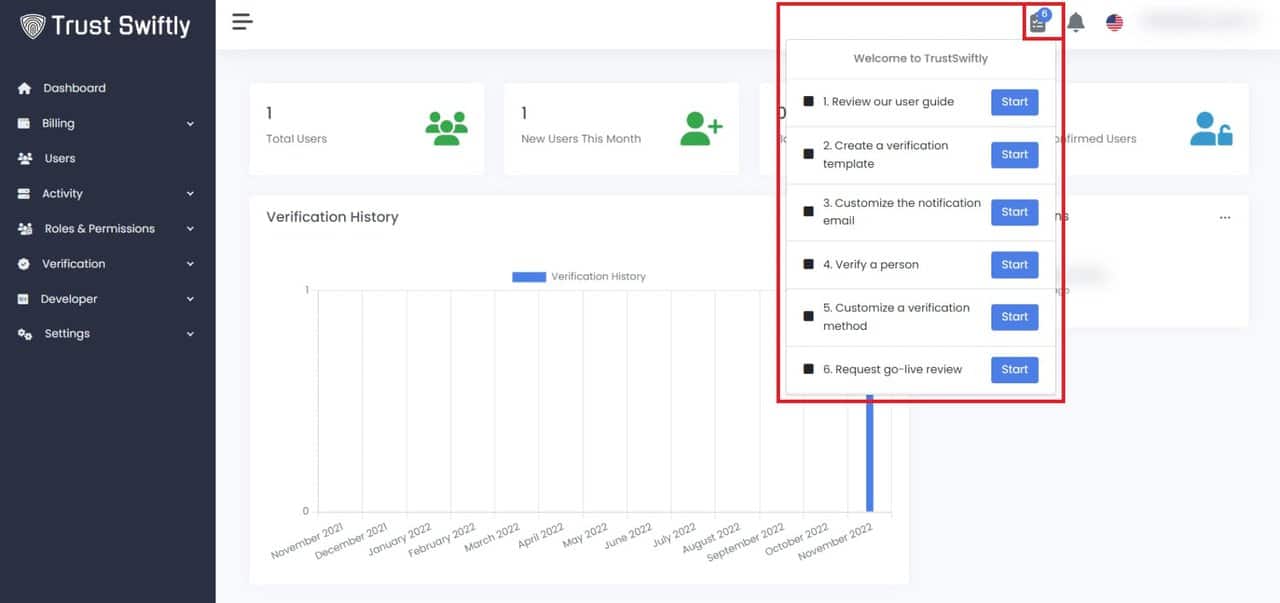

In your Trust Swiftly account, you will see a list of Onboarding Tasks to complete. All these steps need to be completed before your account is fully set up and ready to use. Review each task and complete your account setup.

These settings can be dialed in as you get more familiar with the service and as you have customer run through it.

The last step is having the Trust Swiftly team check your settings and account to verify that it is configured well.

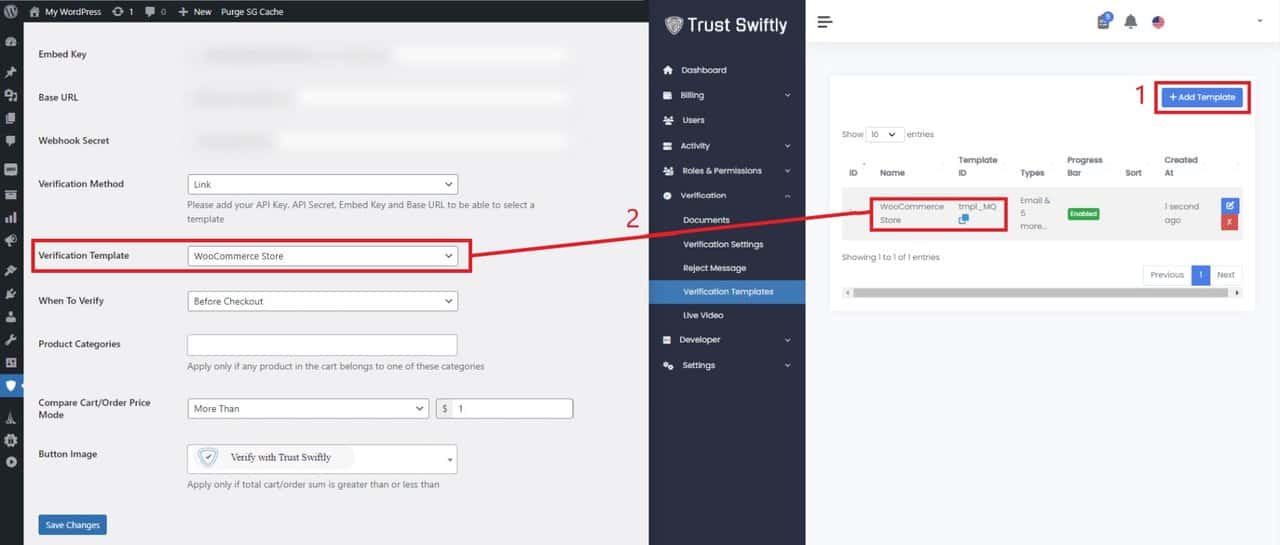

Once your onboarding steps are completed, you can go back to the plugin settings and select your verification template to apply to your store. There are also other various settings to work through as it pertains to your unique store.

If there are any issues along the way, you are very free to contact Trust Swiftly support members with your questions. They can assist at any step along the way and answer questions about the technology, payment, and particular settings. They can be reached at support@trustswiftly.com. Simply ask them your question and provide whatever information you can that would be helpful in their research into your query.

Trust Swiftly Affordable Fraud Protection Pricing

Trust Swiftly is priced very competitively. Instead of charging a monthly amount for a certain number of features and verification requests, Trust Swiftly charges based on use. Its pay-as-you-go pricing structure makes this very affordable for businesses of all sizes.

You are only charged when verifications—risk reduction—have taken place.

That means for smaller and growing WooCommerce stores, you aren’t paying for extra overhead that you aren’t able to use monthly. And for large eCommerce brands, you pay for the amount of risk-reducing verifications you need and no more.

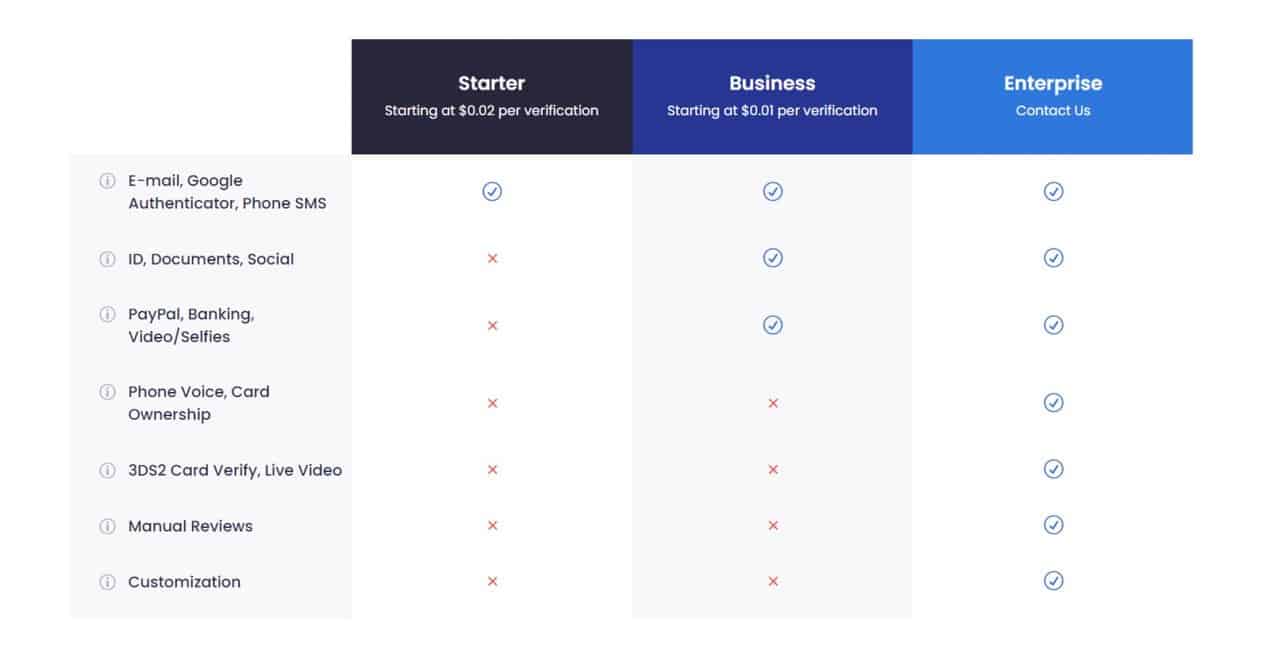

Trust Swiftly’s Starter plan includes email, Google Authenticator, and SMS verification methods. Each verification method starts at $0.02. So, if your template includes both email and SMS verification, your cost per customer starts at $0.04. This is a very small price for reduced fraud, reduced risk, and peace of mind.

The Business plan offers more verification methods. As such, they’ve also generously lowered the starting price per verification knowing that customers are layering together multiple verification methods to create a custom and tailored verification process for their store.

Enterprise plans require a conversation with a Trust Swiftly representative but include many more advance and even custom features. Because of this, pricing is also custom based on the agreement that is drafted.

Trust Swiftly is the Best WordPress ID Verification Plugin

Going through this review, the authors were very impressed with the comprehensive nature of Trust Swiftly. It uses cutting-edge technology, brings enterprise-level SaaS protection to WooCommerce stores, and doesn’t overly burden the end user. This is a very hard balance to strike and the WordPress community stands to benefit from securer WooCommerce stores. The added protection and pay-as-you-go pricing make this a no-brainer for any Woo store.